BTC Price Prediction: Analysts Target New Highs by October 2025

#BTC

- Technical Strength: Price above 20-day MA and middle Bollinger Band supports bullish bias.

- Institutional Demand: ETF holdings and mining investments signal long-term confidence.

- Catalysts Ahead: October 2025 is flagged as a potential cycle top by analysts.

BTC Price Prediction

BTC Technical Analysis: Bullish Momentum Building

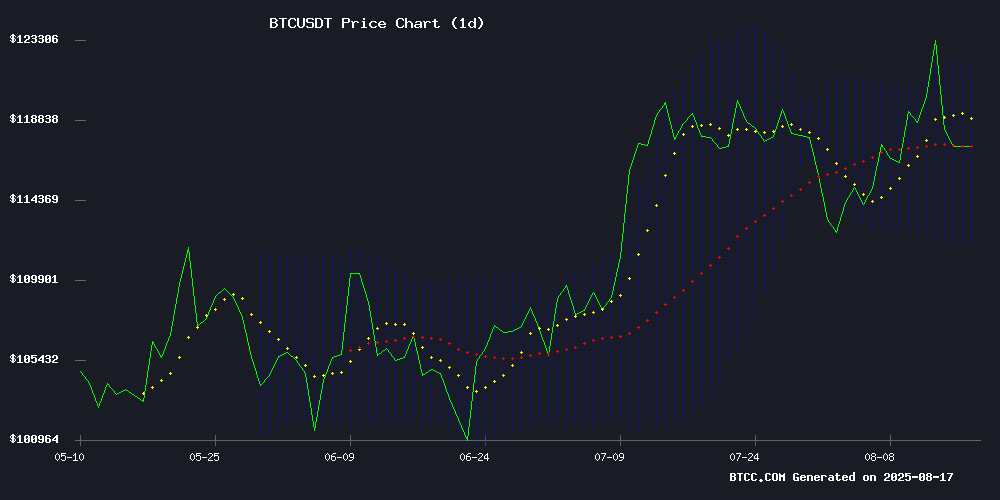

According to BTCC financial analyst Robert, Bitcoin (BTC) is currently trading at $117,988.20, slightly above its 20-day moving average (MA) of $116,941.04. This suggests a neutral-to-bullish sentiment in the short term. The MACD indicator shows a bearish crossover with a value of -1,435.6104, but the price holding above the middle Bollinger Band ($116,941.04) indicates potential support. A breakout above the upper Bollinger Band ($121,874.26) could signal further upside.

Market Sentiment: Mixed but Leaning Bullish Amid Institutional Interest

BTCC financial analyst Robert notes that bitcoin is holding steady at $118K despite global political uncertainty and inflation fears. News highlights include institutional surges (Brevan Howard leading Bitcoin ETF holdings) and mining growth (Hive Digital's record revenue). However, exchange inflows and fading institutional interest pose short-term risks. Overall, sentiment is mixed but leans bullish, especially with analysts eyeing October 2025 for a potential market top.

Factors Influencing BTC’s Price

Bitcoin Holds Steady at $118K Amid Global Political Uncertainty

Bitcoin has reaffirmed its resilience as a potential inflation hedge, maintaining its position near $118,000 despite geopolitical tensions. The cryptocurrency's stability comes as global markets digest the inconclusive meeting between former U.S. President Donald Trump and Russian President Vladimir Putin.

The high-stakes discussion, held during the UN General Assembly in New York, failed to produce a breakthrough in the Russia-Ukraine conflict. Both leaders characterized the talks as productive yet modest in progress, with Putin acknowledging bilateral relations at their lowest point since the Cold War era.

Market participants had anticipated potential volatility from the summit's outcome. Bitcoin's price action suggests investors may be viewing the asset as a hedge against geopolitical risk, particularly as traditional markets brace for continued uncertainty.

Bitcoin Holds Above $117K Despite Inflation Fears as BTC Tests Critical Support

Bitcoin's price exhibited significant volatility this week, peaking at a record $124,514 before retreating to $117,900 amid macroeconomic uncertainty. The cryptocurrency's 0.36% gain over 24 hours masks a 4% drop from its all-time high, triggered by hotter-than-expected U.S. wholesale inflation data.

Market dynamics reveal Bitcoin's dual nature - buoyed by institutional adoption yet still reactive to traditional financial indicators. The neutral RSI reading of 52.33 suggests balanced momentum following the correction, with corporate buying activity and regulatory tailwinds providing underlying support.

Federal Reserve policy expectations remain the dominant narrative, with Bitcoin initially benefiting from dollar weakness before inflation concerns sparked profit-taking. This price action underscores crypto's evolving role as both risk asset and inflation hedge in institutional portfolios.

Brevan Howard Leads Bitcoin ETF Holdings Amid Institutional Surge

Brevan Howard has emerged as the largest holder of BlackRock's iShares Bitcoin Trust (IBIT), with a $2.3 billion position. The firm increased its stake by 71% in Q1, now holding 37.5 million shares—surpassing Goldman Sachs' $1.4 billion allocation. IBIT dominates the spot Bitcoin ETF market with 77.27% share and $87.7 billion in assets under management.

Bitcoin's price rally continues, breaching $124,000 as pro-crypto policies gain traction. Donald Trump's endorsement of cryptocurrency investments in 401(k) plans signals broader institutional adoption. MicroStrategy remains a bellwether, amassing 628,000 BTC worth $73.9 billion.

Bitcoin Price Soars, Analysts Eye October 2025 for Next Market Top

Bitcoin has surged past its all-time high, fueling optimism for further gains. Analysts point to historical patterns and macroeconomic models suggesting the rally may have room to run.

Colin Talks Crypto identifies a consistent 35-month cycle from market bottom to peak, projecting October 2025 as the next potential top. This pattern held through previous cycles despite varying initial conditions.

Alpha Extract's liquidity model shows Bitcoin remains undervalued relative to global money supply, reinforcing bullish sentiment. The tool has historically provided accurate entry and exit signals, adding weight to current readings.

Hive Digital Technologies Reports Record $45.6M Revenue Amid Bitcoin Mining Surge

Hive Digital Technologies (Nasdaq: HIVE) has posted its strongest quarterly performance to date, with Q1 2026 revenue reaching $45.6 million. The surge was driven primarily by Bitcoin mining, which accounted for $40.8 million—a 44.9% increase from the previous quarter. The company mined 406 BTC during the period, up 34% despite rising network difficulty.

Strategic investments in next-generation mining rigs and low-cost, zero-carbon energy sources have positioned Hive as a global leader in Bitcoin mining. CEO Aydin Kilic noted the company now produces approximately 7.5 BTC daily, with plans to expand its hashrate to 25 EH/s by Thanksgiving 2025.

Trump-Backed American Bitcoin Bets $314M on Bitmain Rigs Amid Trade War Tensions

American Bitcoin, backed by former President Donald Trump, has placed a $314 million order for 16,299 Bitmain Antminer U3S21EXPH units. The purchase, capable of generating 14 exahashes per second (EH/s), underscores the intensifying mining arms race where efficiency is paramount. The deal strategically avoids new tariffs imposed by the Trump administration, shielding the company from potential price hikes.

Bitmain, which dominates 82% of the Bitcoin mining hardware market, is responding to geopolitical pressures by planning its first U.S.-based ASIC manufacturing plant by 2025. The move highlights the fragility of a supply chain reliant on Chinese manufacturers, as U.S. miners navigate trade wars and hardware scarcity.

Bitcoin as an Escape from Wage Slavery: A Critical Look at Modern Economics

Adam Livingston, author of The Bitcoin Age, argues that Bitcoin offers a way out of what he terms 'wage slavery'—a system where workers trade their time for depreciating fiat currency. With the purchasing power of the U.S. dollar declining by 95% since the 1970s, Livingston highlights the unsustainable nature of traditional employment in an era of stagnant wages and rising costs.

Livingston's critique centers on the illusion of career advancement in a rigged financial system. 'You sell your time for melting tokens that depreciate while you sit in traffic,' he writes, pointing to the erosion of real wages amid inflationary pressures. Bitcoin, with its fixed supply and decentralized nature, is presented as a hedge against this systemic decay.

The analysis underscores a growing disillusionment with fiat economies, where essentials like housing and food outpace earnings. As central banks continue monetary expansion, Bitcoin's scarcity narrative gains traction among those seeking financial sovereignty.

Bitcoin Faces Pressure as Exchange Inflows Signal Supply Build-Up

Bitcoin (BTC) has encountered selling pressure in mid-August 2025 as rising exchange inflows suggest a potential supply glut. The cryptocurrency retreated 4.1% to $118,612 after briefly surpassing its $124,000 all-time high, leaving traders divided on whether this represents healthy consolidation or the beginning of a deeper correction.

The pullback gained momentum following U.S. Treasury remarks dismissing speculation about potential Bitcoin reserve holdings. This tempered institutional enthusiasm that had previously fueled the rally. On-chain analytics now show concerning activity on Binance, where BTC inflows have surged to seven-month highs according to CryptoQuant data - typically a precursor to increased selling pressure when large holders move coins to exchanges.

Bitcoin Price Slips as Institutional Interest Fades: What’s Next for BTC?

Bitcoin's price dipped 1.3% to $117,517 amid a broader crypto market selloff, with the total market capitalization falling 1.6% to $3.97 trillion. Institutional appetite appears to be waning, as evidenced by the end of a seven-day inflow streak for US spot Bitcoin ETFs. Trading volume dropped 27% to $65 billion, while Bitcoin futures open interest declined 0.5%, signaling reduced participation.

Despite the pullback, analysts remain bullish on Bitcoin's long-term trajectory, viewing the correction as a healthy consolidation before potential upside. Binance saw the sharpest decline in futures open interest, down 2.28% to $15.04 billion, as investors adopted a wait-and-see approach.

Bitcoin Treasury Companies Position for Historic Wealth Transfer, Says Analyst

Bitcoin analyst Mark Moss draws a parallel between today's Bitcoin treasury companies and early 20th-century industrialists who transitioned from gas to electric power. These firms—holding substantial BTC reserves while building financial products—are leveraging existing systems to fund the crypto future, much like factory owners who used gas profits to install electrical infrastructure.

"They looked inefficient. Redundant. Stupid," Moss says of the historical precedent. "They were actually positioning for the most obvious transition in history." Corporations like MicroStrategy exemplify this strategy, channeling value from traditional debt/equity systems into Bitcoin's emerging ecosystem.

Bitcoin Bears Target $113K as Bulls Await Catalyst Amid Mixed Signals

Bitcoin hovers near $117,705 as market participants debate whether the current dip represents a buying opportunity or the start of a deeper correction. The cryptocurrency remains caught between technical support at $116,300—where Fibonacci levels, the 200-day EMA, and historical demand converge—and resistance at $120,000.

Chart patterns reveal conflicting signals. While four-hour RSI shows hidden bullish divergence suggesting rebound potential, daily charts flash warning signs with bearish divergence. A break below $116K could accelerate selling toward $113K-$110K, whereas clearing $120K may open a path to $126K and ultimately $130K.

Market sentiment reflects this tension. The Pectra upgrade's legacy continues to support the broader uptrend, with BTC maintaining higher highs since May. Yet Treasury Department actions and ETF flows introduce uncertainty, keeping traders cautious about positioning for the next major move.

How High Will BTC Price Go?

BTCC analyst Robert projects a potential rally toward $130,000 by October 2025 if BTC holds above the 20-day MA ($116,941). Key resistance levels are:

| Level | Price (USDT) |

|---|---|

| Upper Bollinger Band | 121,874.26 |

| Next Resistance | 130,000.00 |

Bearish scenarios could test $113K support if MACD weakness persists.